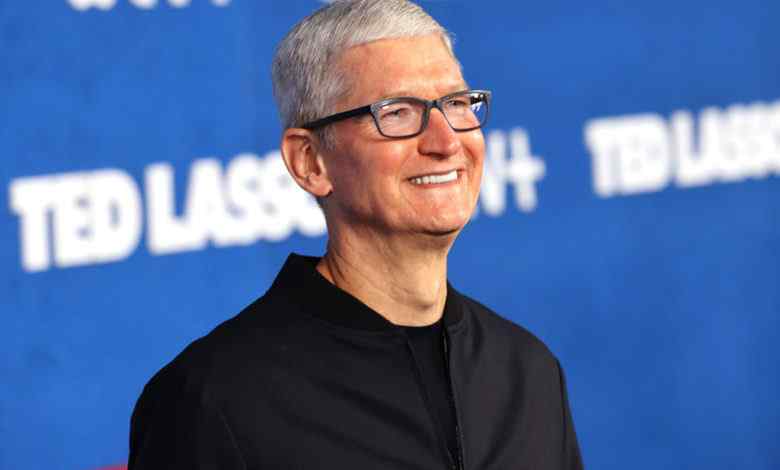

Apple CEO Tim Cook gets $750m payout

Apple CEO Tim Cook has gotten in excess of 5,000,000 offers in the innovation goliath, as he checks ten years in the work.

An organization recording with the US Securities and Exchange Commission (SEC) guard dog shows that he sold the greater part of the offers for more than $750m (£550m).

It is important for an arrangement he struck when he took over from prime supporter Steve Jobs.

The honor relied upon how well Apple’s offers performed contrasted with different firms on the S&P 500 stock record.

As per Apple’s recording with the SEC, Mr Cook was qualified for the honor as the organization’s offers had ascended by 191.83% in the course of the most recent three years.

It likewise noticed that Apple’s offer cost has expanded 1,200% since he became CEO on 24 August 2011.

The organization behind the iPhone, iPad and MacBook currently has a market valuation of nearly $2.5tn.

Last year, Mr Cook consented to another compensation bundle that hurries to the furthest limit of 2026.

A SEC documenting likewise showed that prior this week Mr Cook gave nearly $10m worth of Apple offers to noble cause, without naming the beneficiary.

In 2015, Mr Cook said he would part with his whole fortune before he kicks the bucket, and is known to have given huge number of dollars to good cause.

He as of now has a total assets of around $1.5bn, as per the Bloomberg Billionaire’s Index.

Mr Cook has frequently spoken openly about his interests over issues including HIV and Aids, environmental change, common liberties and balance.

He follows other super rich US finance managers who have said they would part with all or a critical piece of their fortunes in the course of their lives.

In 2010, Microsoft prime supporter Bill Gates and speculation veteran Warren Buffett dispatched the Giving Pledge, which approached tycoons to part with to some extent half of their fortunes.

Recently, Mr Buffett gave to good cause another $4.1bn worth of offers in his organization Berkshire Hathaway.