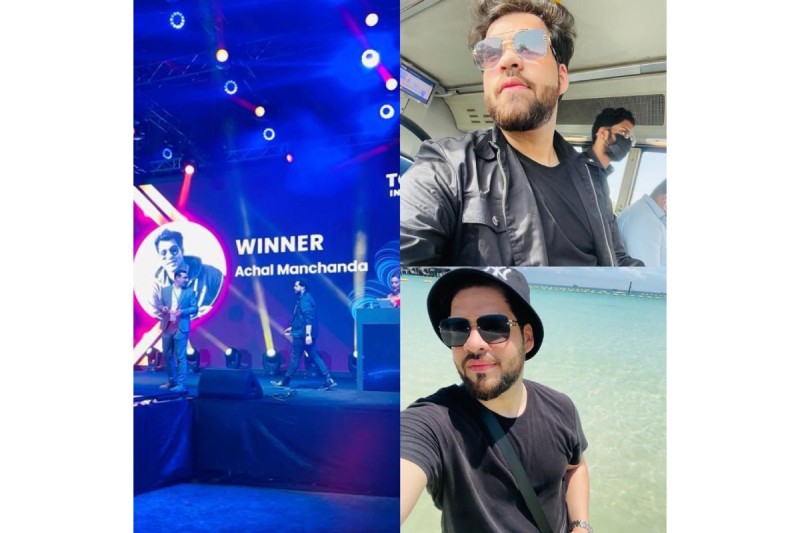

Achal Manchanda Speaks On Recently Added Norms on TDS – Influencers Marketing

Achal Manchanda said ‘I believe with the information we currently have on hand, the most significant change in the brand-influencer relationship can be an increase in cash transactions. This will not impact collaborations, but will overturn the norm of influencers being paid for campaigns in the form of free gadgets, devices, or vacations’

He stated some Pros and Cons of the Influencer marketing –

Bad Impacts for Nano & Micro Influencers :

Nano or micro influencers will not be able to afford these since most of the collaborations are barter only. As an agency, we feel this is not going to be a very good situation for the influencers or the brands,

Destabilise the whole industry (HOW) :

For instance, PR is a big part of the influencer industry. Influencers create a resonance with the brand only when they talk about a product after receiving the package sent to them as a gift through a PR professional. The whole idea of influencers being advocates goes for a toss if they have to pay TDS for a free gift. It puts the whole transactional value into an aspect even if the influencer likes the product and talks about that gift that was sent to him/her.

Pros :

This is quite an incentive for aspiring influencers. And even though it has become quite the norm in the influencer marketing space, the industry is so much more than just getting freebies

The government’s decision to levy 10% TDS on free gifts like cars, mobile phones, etc. is indicative of the industry becoming more mainstream and regulated.

It will only require influencers to become more structured with their taxes and filings as it will contribute to a more transparent economic system in the country. This in no way is a disincentive for any aspiring influencer.

Conclusion : This new provision will ensure that those individuals, who are getting benefits from such sales provision expenditure by different businesses, report it in their tax returns and pay their tax on all those benefits which are worth and not retained back. This will in turn save these businesses from opening up a lot of practical issues with their return, for which they have not braced themselves