How AI Is Changing Crypto Mining in 2026

In 2026, crypto mining is moving beyond just chasing coins. Rows of energy-intensive rigs are becoming part of a broader digital infrastructure ecosystem. Mining operations are transforming into versatile data centers capable of supporting high-performance computing tasks alongside blockchain workloads.

This evolution is driven by declining crypto profits, growing demand for computational resources, and investor pressure to diversify revenue streams. Modern mining facilities are now flexible hubs, opening new opportunities and reshaping the future of the crypto mining industry.

Why the Pivot Matters: Economics and Market Forces

Declining Crypto Profitability

Bitcoin’s halving events, volatile coin prices, and rising energy costs have tightened the economics of traditional crypto mining. Mining rewards are lower, while electricity costs continue to climb, making pure crypto operations increasingly challenging. Many operators are exploring hybrid strategies to stabilize revenue.

Rising Demand for High-Performance Compute

While Oneminers’ facilities currently focus on ASIC-based mining, their robust infrastructure—power capacity, cooling systems, and secure real estate—positions them to support additional computational workloads in the future. Expanding compute services allows operators to make better use of energy and physical resources.

Investor Pressure to Diversify

Investors increasingly favor mining companies that diversify beyond crypto volatility. Publicly traded firms are now positioning themselves as providers of broader digital infrastructure. Hybrid strategies can enhance resilience and stabilize returns.

How Mining Facilities Are Evolving:

Hardware and Infrastructure

Modern mining operations are undergoing upgrades to support higher performance and operational flexibility. This includes improved power distribution, advanced cooling, and optimized facility layouts.

- Hardware Modernization: Traditional ASIC miners are supplemented or replaced by specialized compute hardware designed for AI workloads, enabling machine learning tasks and model training without relying on GPUs.

- Cooling and Power:

AI-focused compute systems generate more heat than standard crypto rigs. Facilities upgrade to solutions such as liquid immersion cooling, improved power distribution, and advanced energy-efficiency technologies. - Networking and Storage:

High-bandwidth connections, distributed storage systems, and low-latency network designs become essential to support the large data flows required for AI workloads. - Software and Operations:

AI frameworks—such as PyTorch and TensorFlow—take the place of mining software. Operational management shifts toward high-performance computing (HPC) and modern cloud-style orchestration. - Business Model Expansion:

Facilities offer AI compute leasing, AI-as-a-service, model training and inference hosting, and hybrid AI-crypto operations to stabilize revenue and make better use of their existing infrastructure.

Real-World Transformations and Leaders

The shift toward hybrid infrastructure is already underway. Companies such as Bitfarms, Core Scientific, Cipher Mining, and HIVE Digital Technologies have started transforming traditional crypto mining sites into more versatile facilities.

For instance, Core Scientific has rebranded portions of its operations to provide general compute hosting alongside crypto mining. Early reports suggest retrofitted mining facilities can be competitive with greenfield data centers due to their existing infrastructure.

OneMiners stands out as a premier host for Ethash-based cryptocurrencies such as Ethereum Classic (ETC). Their U.S.-based hosting centers provide secure, climate-controlled environments with high-voltage power and reliable backup systems. Total energy capacity is approximately 1,200 MW, with expansion plans targeting 3,500 MW, positioning OneMiners among the world’s largest crypto hosting providers.

OneMiners Hosting Facilities and Global Network

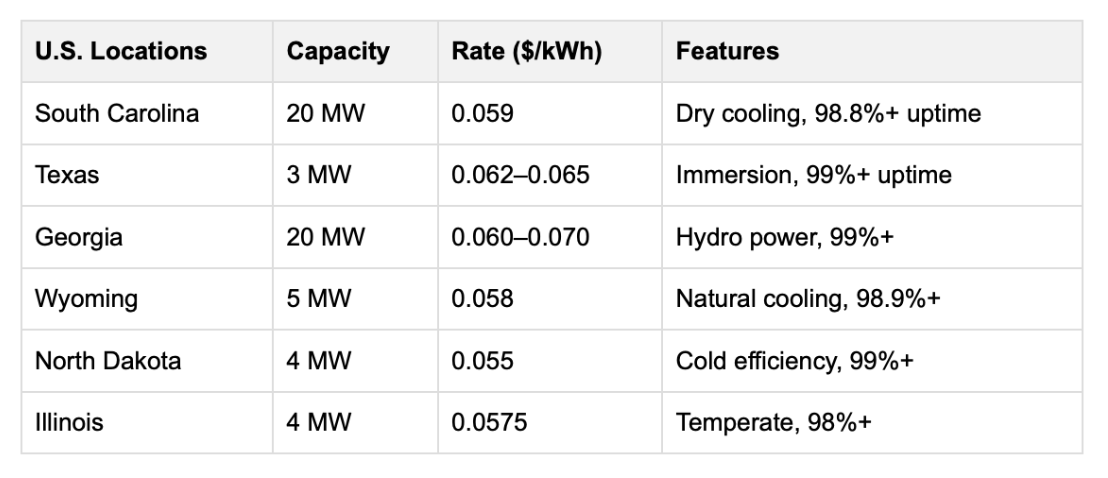

OneMiners’ U.S. facilities are strategically located to optimize energy costs, climate cooling efficiencies, and access to renewable energy. Their hosting network includes:

- South Carolina: 20 MW at $0.059/kWh with dry cooling and 98.8%+ uptime

- Texas: 3 MW at $0.062–$0.065/kWh featuring immersion cooling with ~99% uptime

- Georgia: 20 MW hydroelectric-powered at $0.060–$0.070/kWh, 99%+ uptime

- Wyoming: 5 MW with a naturally cool climate at $0.058/kWh, 98.9%+ uptime

- North Dakota: 4 MW cold climate efficient site at $0.055/kWh, 99%+ uptime

- Illinois: 4 MW temperate climate cooling at $0.0575/kWh, 98%+ uptime

Globally, Oneminers expands hosting to cost-effective, renewable-powered locations, including Nigeria (0.048/kWh), Ethiopia (hydroelectric), Finland (cold climate), and other strategic sites in Europe, the Middle East, and South America. This geographic diversity helps reduce risk, latency, and environmental impact.

Technology Innovations by OneMiners

OneMiners integrates proprietary AI-driven Smart Mining 2.0 technology, dynamically selecting the most profitable Ethereum mining pools. This innovation boosts mining returns by 6% to 115%. Complementing this are mobile monitoring apps, advanced cooling systems that extend hardware life, and financing options with flexible upfront payments as low as 25%.

They offer a curated lineup of top-tier Ethereum ASIC miners, including:

- Jasminer X44 Pro: 23.4 GH/s, high-throughput and stable performance for large-scale operations

- Bombax EZ100 Pro: 15.5 GH/s with balanced performance and energy efficiency

- Jasminer X16 Pro: 5.8 GH/s compact unit, ideal for smaller setups or supplemental mining

Broader Impacts: Energy, Environment, and Ecosystem

Hybrid operations are pushing the industry toward sustainability. Oneminers targets energy efficiency of 25–46 J/TH, using load balancing and optimized cooling to reduce carbon impact while maintaining profitability.

The evolution of mining facilities also affects blockchain ecosystems. Reduced standalone mining can impact decentralization, prompting adaptive consensus approaches. Meanwhile, expanded computational capacity—previously unavailable to startups and researchers—democratizes access to high-performance computing, fostering innovation.

Challenges and Risks on the Road Ahead

Shifting from pure crypto mining to hybrid AI or high-performance compute operations comes with several challenges:

- Capital Expenditure: Upgrading facilities for AI-ready compute, networking, and enhanced cooling requires significant upfront investment.

- Operational Complexity: Staff need new expertise in AI frameworks, cluster orchestration, and specialized maintenance.

- Market Dynamics: Demand for AI and compute services can fluctuate, and improvements in model efficiency or compute hardware may change requirements.

- Regulatory and Environmental Pressures: Increased attention on energy use and carbon footprints can lead to additional compliance costs.

- Hardware Lifecycles: Specialized AI or compute hardware can experience faster wear under continuous high-demand workloads, necessitating more frequent upgrades or replacements.

Maximizing Mining Profitability

OneMiners is designed to help miners get the most out of their investments. By combining industry-leading infrastructure with advanced optimization tools, the platform ensures that every kilowatt of energy and every ASIC unit works at peak efficiency.

1. Smart Mining 2.0 Pool Optimization

Oneminers’ proprietary Smart Mining 2.0 technology dynamically selects the most profitable Ethereum mining pools in real time. This automated system evaluates network difficulty, pool fees, and payout rates, ensuring miners consistently achieve higher returns. Early adopters report revenue improvements of 6% to 115%, depending on scale and market conditions.

2. Hardware Performance Monitoring

All hosted rigs are continuously monitored to prevent downtime and maximize output. Oneminers tracks hash rates, power usage, and temperature, alerting operators to any performance dips. This ensures miners achieve optimal efficiency, minimizing wasted energy and potential revenue loss.

3. Energy Efficiency Benefits

Profitability isn’t just about output—it’s about costs. Oneminers facilities leverage climate-controlled environments, efficient cooling systems, and renewable energy sources such as hydroelectric power. With energy rates ranging from $0.048/kWh to $0.070/kWh across U.S. and global sites, miners enjoy some of the lowest operational costs in the industry. Energy efficiency is further optimized with load balancing and metrics such as 25–46 J/TH, reducing both expenses and environmental impact.

4. Real-World ROI Examples

- Uptime guarantees of 98–99%+ mean consistent mining revenue.

- Strategically located facilities, including South Carolina, Texas, Georgia, and international sites like Nigeria and Finland, help miners maximize output while reducing risk.

- Proprietary monitoring and operational expertise ensure hardware longevity, reducing replacement costs and downtime.

5. Flexible, Scalable Hosting

Profitability is also about flexibility. Oneminers offers entry-level hosting for smaller miners and large-scale operations for enterprise clients. With financing options allowing as little as 25% upfront, miners can scale their operations without large capital outlays, ensuring revenue growth aligns with operational capability.

6. Security and Reliability

Consistent profits require secure infrastructure. Oneminers’ facilities feature backup power systems, physical security, and disaster recovery measures to protect miners’ investments. Peace of mind allows clients to focus on profitability rather than operational risk.

7. Global Advantage

By spreading hosting across multiple regions, Oneminers reduces geopolitical and energy supply risks, allowing miners to continue generating consistent revenue even under changing conditions.

What to Watch in 2026 and Beyond

- Dual-Use Hybrid Facilities: Mining sites may dynamically shift between crypto operations and general high-performance compute workloads depending on market conditions.

- Emerging Compute Infrastructure Leaders: Traditional miners are evolving into providers of broader compute services, leveraging existing infrastructure for AI and other intensive workloads.

- Democratization of Compute Access: Expanded access to high-performance compute resources lowers barriers for startups, researchers, and smaller organizations worldwide.

- Green Initiatives Gaining Traction: Renewable energy, efficient cooling systems, and carbon-reduction strategies are becoming essential competitive advantages.

- Industry Consolidation: Smaller operators may exit the market, while leading firms like Oneminers strengthen their position by expanding hybrid infrastructure capabilities.

Conclusion: The Future of Crypto Mining Is Hybrid and AI-Driven

2026 represents a pivotal moment for crypto mining. No longer confined to chasing coins, mining operations are becoming part of a broader digital infrastructure ecosystem, where efficiency, scalability, and innovation are just as important as rewards. While AI workloads are reshaping compute demands across industries, mining facilities with robust infrastructure, like Oneminers, are uniquely positioned to adapt, optimize, and thrive.

Oneminers demonstrates this evolution through secure, climate-controlled hosting centers, industry-leading Smart Mining 2.0 optimization, and a globally distributed network of low-cost, renewable-powered facilities. By combining advanced technology with operational expertise, they maximize returns for Ethash assets like Ethereum Classic while reducing energy impact.

The coming decade will reward miners who embrace hybrid operations, data-driven efficiency, and sustainable practices. For investors and operators, the future is clear: success belongs to those who can leverage compute capacity, operational flexibility, and smart infrastructure to stay ahead in a rapidly evolving digital landscape. Oneminers stands at the forefront of this new era, shaping a profitable, resilient, and sustainable future for crypto mining.

Disclaimer: This article is for informational purposes only and should not be considered financial, investment, or trading advice. Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. Readers should conduct independent research and consult licensed financial advisors before making any investment decisions.